The Legislative Session has concluded after a 60 day marathon of new and recycled bills, impassioned testimonies, committee meetings and vigorous debate. Lawmakers submitted over 900 pieces of legislation for the 60 days, and passed just shy of 200 in both the House and Senate. Whether or not the Governor signs all of those bills is still yet to be seen as many are awaiting her signature or veto.

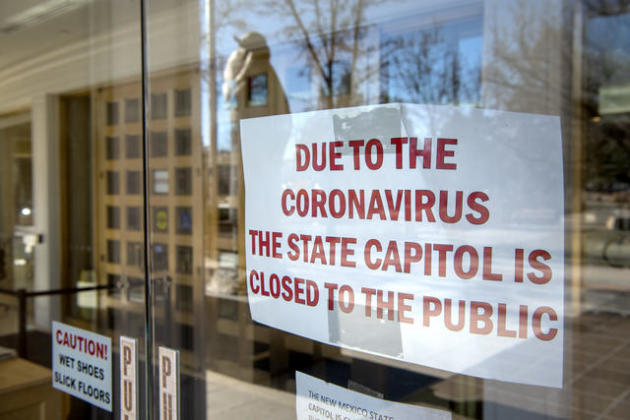

This was also the first time the Legislature operated in a hybrid form of Zoom calls and sparsely populated offices at the Roundhouse. The digital format for the session allowed for new flexibility by allowing legislators to conduct work from home or their offices, while also maintaining social distancing and public health guidelines. The capitol building unfortunately, was completely off limits to members of the public for the entirety of the session. The price for securing the capitol building is north of $700,000, but no exact figure has been given.

However, the “cyber session” also had some significant setbacks for the public in spite of being touted as offering unprecedented access to the session for regular New Mexicans. More often than not, the public, lobbyists and even those testifying in both House and Senate committees were unable to make their voices heard. In the past if you needed to testify on behalf of or against a bill, you would simply show up to the committee meeting and make your case before the committee members as they deliberated, but not this year. Without an invitation to a Zoom call committee hearing the public was largely left out from anything more that watching. NMBC’s call to action brought this issue to the attention of legislators but it was largely ignored.

As always, NMBC was a champion for business friendly legislation that would encourage job growth and expand opportunities for New Mexicans. While that is rarely the same priority as most legislators NMBC was able to rack up some critical victories for business while stopping (most) bad legislation from making it to the Governor’s desk. For a complete list of bills the NMBC worked on this session Click HERE.

Listed below are the critical bills that NMBC devoted much of our time to this session and some insight from our CEO and Founder Carla Sonntag.

HB 148 Unemployment Contribution Rate Change, Rep Chandler. This bill increases the base level tax that employers would pay for each employee as well as the ceiling on contributions, making this a significant 238% tax increase overall.

NMBC strongly opposed HB 148 Unemployment Contribution Rate Change and felt the state should correct the issue it created with the unemployment fund. This is absolutely the worst time to raise any tax on New Mexico businesses, many of which are struggling to stay in business due to the ongoing government restrictions placed on their operations.

This tax increase will impact businesses that never had layoffs during the pandemic as well as those who had massive layoffs through no fault of their own.

Prior to the pandemic shutdown, New Mexico’s unemployment fund had a balance of $459.7 million, with every dime paid into it solely by employers. Because of the Governor’s shutdown orders, employees were forced out of work and unemployment claims spiked to record levels. As a result, New Mexico’s unemployment compensation fund was depleted and reached insolvency in September 2020 causing the state to borrow hundreds of millions of dollars from the federal government.

Interest accrued on these federal loans cannot be paid directly or indirectly by unemployment compensation fund revenues. Annual interest payments are expected to be more than $3 million dollars and possibly continue for several years, if action isn’t taken to replenish the fund with incoming federal relief dollars.

HB 268 Coronavirus & Workers’ Comp, Reps Hochman-Vigil, Ely, Chandler, Dixon & Garratt. This bill would’ve placed the burden of the ongoing health pandemic on the shoulders of business owners – as if they didn’t bear it already! It would allow essential employees to claim exposure to Covid-19 at work and place legal defense on the employer to rebut.

The New Mexico Workers’ Compensation (WC) system was developed for workplace related injuries. It was designed to provide a quick and efficient means of caring for an injured worker and removes the concern of litigation. This keeps the costs down and provides the best possible care for the injured worker.

WC was not designed for claims arising from viruses and should not be used for this purpose. Essential employees would not be required to prove that they were actually exposed to Covid-19 at work, but could claim coverage under their employer’s WC policy. This significantly increases employers’ potential liability and would likely result in additional expenses including interruptions to business operations and other associated administrative costs. Importantly, this type of open door policy on WC claims could bankrupt some of the private and group WC funds in New Mexico.

This bill had the potential to bankrupt the state and privately managed WC funds and at the very least would have meant significantly higher WC rates to cover the potential liability.

HB 50 Private Right of Action For Certain Statutes, Rep Louis. This bill would have harmed many New Mexico industries, including: insurance, manufacturing, agriculture, and the extractive industries by allowing anyone to file a lawsuit for any environmental harm, past or present.

The provisions outlined in HB 50 put businesses and industries in a precarious situation that leaves them at significantly higher risk for lawsuits by allowing for unlimited private action opportunities. It makes it easy for anyone – at any time – to sue without guidelines or limitations of cause or reason. Furthermore, with no statute of limitations, the legislation would create even greater uncertainty for businesses and would be a significant deterrent to business expansion and diversification at a time when we most need that to occur.

SB 149 Prohibit New Fracking Licenses, Sen Sedillo-Lopez and Rep Roybal-Caballero. For a state that gets up to 40% of its annual revenue, this never ending assault on the extractive industries is ridiculous.

HB 110 Phased Minimum Wage Increase, Reps Roybal-Caballero and Ferrary. Even before the full implementation of the 2019 minimum wage increases that are already hurting employees looking for jobs and employers trying to create them, this bill would up the ante to a $15 minimum statewide wage.

SB 35 Minimum Wage For Secondary School Students, Sen Steinborn. removes the exemption for students to be paid a training wage and will mean less jobs for students. It has already been signed by the governor.

HB 236 Public Banking Act, Reps Roybal-Caballero and Thomson & Sen Steinborn and also SB 313 Public Banking Act, Sen Steinborn. These bills would have created a state bank by diverting state taxpayer dollars to fund and putting those dollars at great risk while hurting local community banks.

Community banks excel in being a quality community partner that meets the needs of small businesses and consumers. There are over 220 locations throughout the state, safely providing 60 percent of all small business loans and more than 80 percent of all agriculture loans.

One of most important issues for providing safe loans is to have an established relationship with the consumer. There is no better scenario than a community bank where the banker making these decisions has established relationships and knows, first hand, the needs of the community as well as the consumers. This is something that will not be easily accomplished by a public bank, risking the resources of the state, if a borrower fails to repay the loan. This puts New Mexico taxpayers at a higher risk for loss of tax dollars.

Community banks have their own dollars at risk, not those of our state’s taxpayers. In addition, they are well experienced and have a proven track record of providing for the needs of businesses and consumers in their respective communities. During the pandemic, our community banks provided the largest portion of New Mexico Paycheck Protection Program (PPP) small business loans totaling over $1.2 billion in just under 9,500 loans.

Community banks are the partners New Mexico needs in every community. They are well established and well respected and should not be forced, after many years of operation, to compete with a state bank. In addition, capitalizing a public bank will divert needed state revenues from more immediate needs. New Mexico has limited resources, exacerbated by the pandemic response. Investing taxpayer funds in something so risky for the state is ill advised.

SB 86 Use of Water for Oil and Gas Operations, Sens Sedillo Lopez and Stefanics. This bill would have created problems for the extractive industries that had accomplished a great deal in conserving and reusing water.

The main problem is that it would have created confusion over the use of 2019 Produced Water Act (the Act), which has only been in effect for less than two years. The Act encouraged the reuse and recycling of produced water – especially in the oilfield. The Act also created additional regulatory oversight for produced water use within the State by the NMED and NMOCD.

SB 86 was not necessary would have created additional hardship on oil and gas operations, which is a large part of New Mexico’s revenue. Instead of continually creating additional obstacles for this industry, the New Mexico legislature would benefit all New Mexicans by working with industry leaders to develop and implement best practices.

Of special interest…

HB 291 Tax Changes, Reps Martinez, Chandler, and McQueen. This bill was one of the worst attacks against New Mexicans and most especially against business owners. The bill passed but . . .

The bill passed but it was gutted. The original bill increased income taxes starting at $75,000 married filing independently and went up significantly from there. In addition, it increased corporate taxes 60% over five years and took away most of the exemption for capital gains deductions.

What many people miss is the fact that 85% of New Mexico businesses pay tax as a pass through at their personal income tax rate. That means that there would be few, if any businesses that wouldn’t experience a tax increase on business earnings. This means less revenue to invest in job creation.

This bill was gutted in Senate Finance of all tax increases. Special thanks to Senator Munoz, who submitted the amendment, and Rep Martinez who agreed to it as well as all of the Senators who supported it in committee. The only thing left in the bill was an expansion of the Low-Income Comprehensive Tax Rebate (LICTR) and the Working Families Tax Credit (WFTC). The bill is on the Governor’s desk.

Bills NMBC supported or thought they were better than other alternatives

HB 278 Manufacturing Services Gross Receipts, Reps Harper & Martinez. This bill expands the manufacturing GRT deduction to include manufacturing services on tangible property owned by a manufacturer. It is a good investment in economic diversification, but we were disappointed that it was amended in the last hours of the session to exclude the 100 percent gross receipts tax deduction for the sale of certain interbusiness services, including: legal services, accounting services, financial management services, human resources services, information technology services and temporary services.

The issue of taxing services has been a serious detriment to businesses expanding or coming to our state. That tax has never made sense and it is long past due in being corrected. Additionally, the six categories of services, plus manufacturing services that would become deductible under this bill, are highly correlated with undesirable pyramiding under the current gross receipts tax laws.

SB 304 Voting District Geographic Data, Sen McKenna. This bill provides for a citizen redistricting committee, led by a retired Supreme Court judge with balanced representation of various urban/rural areas of the state. The committee will hold public input meetings and compile three precinct, state and federal district plans based on population data that will be presented to the NM legislature no later than October 30, 2021.

SB 3 Small business Recovery Act, Sen Candelaria & Rep Matthews.

This bill redefines and expands the June 2020 special session legislation to provide business loans. It set aside a total of $500 million and while we appreciate the desire to help, the business community made it abundantly clear that they want to operate safely at 100%, not accumulate more debt in this unprecedented and precarious time.

The bill provides for a longer term and very generous repayment terms, which will help some businesses to qualify and repay a loan designed to help them stay in business. SB 3 raises some underwriting concerns because the loans do not require a personal guarantee under $75 thousand nor do borrowers need to provide a certification that the business does not reasonably expect to cease operations or declare bankruptcy. This is very unusual and may lack responsible underwriting guidelines and procedures, which puts the state at greater risk for default.

HB 11 GRT & Permanent Fund For LEDA Projects, Speaker Egolf & Rep. Chandler. This bill provides $200 million in grants to be used towards lease and mortgage costs for businesses impacted by the pandemic and health order in New Mexico. Businesses may qualify for up to $100,000 to be distributed in four quarterly payments and because these are grants, no repayment is required.

SB 93 Broadband Access & Expansion Act, Sens Padilla & Stefanics. This bill is a government growth bill, but is seeking to correct a significant deficiency in the state with broadband access. It establishes the office of Broadband Access and Expansion to develop a three-year statewide broadband plan on or before 1/1/22.

There were multiple bills that seriously should have passed this session but did not:

- HB 139 Legislative Oversight of Emergency Declarations, Reps Nibert, Ely, and Rehm.

- HJR 6 Termination of Emergency Declarations, Ca, Reps Nibert, Ely, and Rehm.

- SB 74 Public Health Order Termination and Renewal, Sen Baca.

- SB 364 Public health Order Business Occupancy, Sen Sanchez.

These bills would have provided the checks and balances that were inadvertently omitted from the legislation that provided for emergency orders. It is never a good idea to allow a single party to unilaterally make decisions of the magnitude seen over the past year that resulted in the loss of over 2,000 businesses and 87,000 jobs.

Our government is designed to have checks and balances and these bills would have addressed what is currently missing. When the original legislation was created following the 9-11 attacks, the legislature could not have known that a pandemic of this magnitude would impact the world. The original legislation providing the executive emergency powers was necessary and well-intentioned. It has, however, become important to correct the deficiency created of not allowing for legislative oversight on extended use of the executive authority.

The governor stated she would veto any bill on this subject that made it to her desk. While it is most unfortunate to see threats of action to something that is only good practice, one of the bills, HJR 6, bypassed the governor’s veto option by going to the public for a decision on the validity of this measure.

- HB 49 Exempt Social Security From Income Tax, Reps Brown, Dow, Armstrong, Pettigrew, and Ezzell.

- SB 78 Exempting Social Security From Income Tax, Sens Padilla and Stefanics.

- SB 162 Exempt Social Security From Income Tax, Sen Campos.

- SB 208 Exempt Social Security From Income Tax, Sen Gallegos.

These bills would have stopped the taxation of Social Security income, making New Mexico the 38th state to do so. Most people work many years to reach retirement and collect their social security earnings. Many of these retirees are on a small fixed income and need every penny they get. It’s long overdue for our state to get past the tax and spend greed and let retirees enjoy the fruits of their hard work.