“Opportunity zones” are low income communities designated by the federal government as ripe for economic development. Under new legislation, taxpayers investing in these zones that meet the necessary criteria will be able to defer, reduce and exclude capital gains taxes through timely opportunity zone investments.

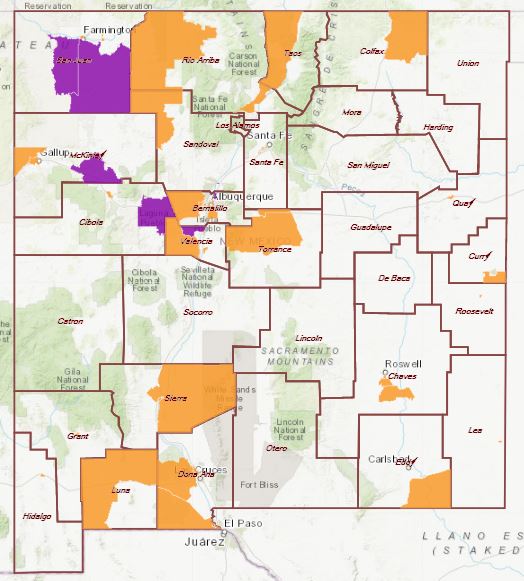

As of Friday, May 18, 2018, the Department of the Treasury designated 63 Opportunity Zones in New Mexico. New Mexico’s Opportunity Zones are located in rural, tribal and urban communities in 22 counties. Qualified Opportunity Zones retain this designation for 10 years.

Governor Lujan Grisham’s administration has framed this as a way to reinvigorate rural, aging or otherwise economically troubled areas by opening them up to new investments. However, according to economist Elliot Eisenberg, “the trouble with opportunity zones is the creation of different tax rates for marginally different types of investment… These tax treatment differences create huge opportunities (loopholes) for abuse and can only be countered by very careful legislative drafting and strong enforcement.”

The criteria for receiving the opportunity zone benefits includes the project being in one of nine key industry sectors that were identified by Lujan Grisham’s administration; create a minimum of $2.5 million in annual payroll — $3.5 million if located in Albuquerque, Rio Rancho or Santa Fe — and pay average salaries of 2 percent more than the county average; commit to a 10-year agreement; have a capital investment of $15 million or higher; be an expansion or out-of-state relocation, according to the department.

Economic Opportunity Zones sound like a decent enough plan for stimulating business development where it’s needed, but will it actually be the live up to the governor’s ideals or become another failed state give away program?